Are you looking for a quick, easy and completely streamlined way to get some extra cash in your business, all from the comfort of your own home?

We have partnered with a number of businesses who offer funding to companies just like yours, and you can have the money you need in your account in a number of hours.

Overcoming cash flow challenges

The fact is, as your business grows, you won’t always have a positive cash flow. You might need a chunk of money as a down payment for new equipment, agency fees if you’re recruiting, or when a growth spurt means you need to pay out substantial costs before your client will pay you. Whatever the reasons, these are all things that require a short-term injection of cash; and we have found a solution for you!

The usual forms of funding aren’t for everyone. Some business owners don’t want to sell shares to investors, they don’t want to tie their business loans to their personal properties, and they have no other business assets to use as leverage. And no-one ever really wants to spend hours at the bank filling in forms anyway.

As an alternative, many of our clients have benefited from a fully digital experience, getting the cash they need, and getting it quickly. The markets are changing and you no longer need to go down the usual routes. With many funders, you can sign up online in minutes, and have a decision within hours.

Here are two such examples:

And the best bit? Many of these lenders link to online accounting software such as Xero.

This link between Xero and iwoca, for example, allows real-time information to pass between the companies, meaning funding can be reviewed and approved incredibly fast. In fact, with the right guidance, you can enjoy a completely digital and streamlined financial workflow experience.

From Xero to digital banking alternatives such as Tide and Revolut to iwoca, your financial information can be managed entirely online and accessed from your smartphone or tablet device. Raising cash for your business has never been easier, or more convenient.

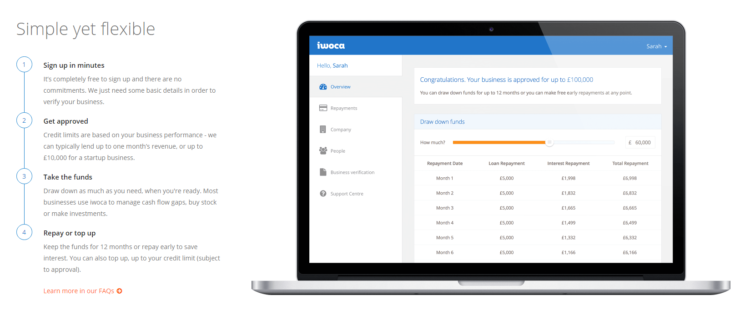

iwoca: Key Features & Requirements

iwoca will typically consider a range of businesses of all shapes and sizes, from startups to established companies. However, you are required to have a UK-based business and operate as a sole-trader, partnership, or limited company. There is also a limit on how much startups can borrow, which is a maximum of £10,000.

What’s more, iwoca stands apart from many other lenders thanks to their key features of speed, flexibility, and fairness:

- They use technology to make an appropriate and fair decision based on your business performance, and not just your credit score.

- If you’re successful with your application, you can expect to see funds in your account in a matter of hours.

- You can repay the loan as soon as you like (no early payment penalties), and you only pay interest for each day you have the funds.

Alternative Business Funding (ABF): How it works

In four simple steps, you can secure necessary business funding online with ABF.

Here’s how it works:

- Enter the amount of funding you need, the length of time you need to borrow it, and how soon you need it in your bank account.

- Next, answer some simple questions and watch as finance providers are ruled in or out based on your answers. When you’re finished answering, you’ll be presented with the funders that are a perfect match.

- Now you can choose to engage them or not. Choose the funders you’d like to approach, and all without negatively impacting your business credit rating.

- Finally, interested funders will contact you.

Check the ABF FAQs for more information.

So, what are your options?

- Short Term Loan

- Invoice Financing

- Asset Finance

- Equity Release

There are pros and cons to each option – and we can discuss this in detail to review what is going to work best in your circumstances. You can book an initial consultation with the team and we can get you the money you need.